Form 1065 in a spreadsheet format if more convenient. Affiliate relationships include but are not limited to Bluehost Amazon Associates and StudioPress. Securities and Exchange Commission The bottom line for this statement is the businesss net income or. Unlike limited partnerships and limited liability companies shareholders of S corporations must divide the corporations net income in strict proportion to their shares of ownership. There are three major types of expenses we all pay. The good news is that because staff are a business expense the costs associated with employment are deductible from your profits. The next step in setting up a budget is to list your monthly expenses. When I first started budgeting I set up an excel spreadsheet for the year. The Income Statement also called the Profit and Loss Statement is a report that shows how much revenue a company earned over a specific time periodit also shows the costs and expenses associated with earning that revenue US. Lets take a look at what HMRC says you can claim as a limited company.

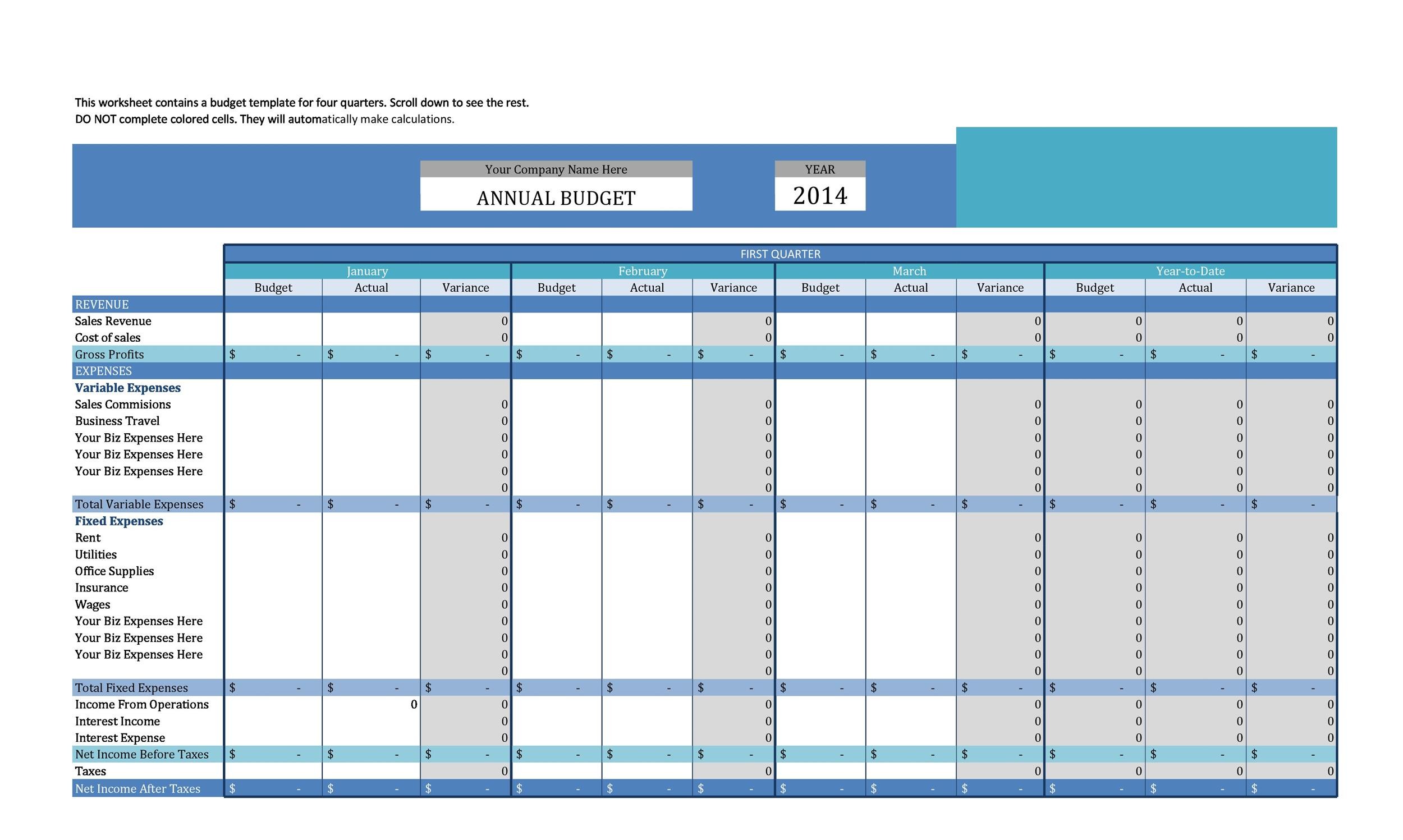

You can also use spreadsheet software. You might want to create an expenses spreadsheet which you can update and amend throughout the year. On the other hand a limited company can choose to distribute its. For a limited company however the corporation tax rate is currently 19 set to fall to 17 by 2020 which is a substantial saving. If you own a Limited Company tax can be a bit more complicated. Click the button below to download your FREE bookkeeping softwaretemplate for Limited Companies. Business can take rent expenses as a tax deduction provided that the property is used for business purposes the cost is. Anybody who runs a business knows the importance of a business budget template. Use the links below to view the sample templates available at the HMRC website Sample accounts Sample accounts for dormant company Charity accounting templates. It was a daunting task to think about what my expenses would be for the next twelve months.

The receipts you collected in the previous section. Accruals accounts CC17 SORP FRS 102 for charitable companies Our free templates Trial Balance Template Bookkeeping Template Sales Debtors Record Template Expenses Template inc Mileage Claim and Use of Home. Sample Monthly Expenses Spreadsheet. Line 18a through Line 18c Tax-exempt Income and Nondeductible Expenses Enter on Schedule K 568 the amounts of tax-exempt interest income other tax-exempt income and nondeductible expenses from federal Schedule. Get 60 off most FreshBooks plans for the first 6 months for a limited. Even ordinary housewives at home who have limited finances usually make some form of budget to make ends meet. Fixed variable and periodic. Lets take a look at what HMRC says you can claim as a limited company. This confirms how much dividends you can pay. Income and expense spreadsheets can be useful tools to help you see where your personal or business finances stand.

Use the links below to view the sample templates available at the HMRC website Sample accounts Sample accounts for dormant company Charity accounting templates. You can also use spreadsheet software. Even ordinary housewives at home who have limited finances usually make some form of budget to make ends meet. 20182019 Bookkeeping Spreadsheet. Anybody who runs a business knows the importance of a business budget template. Income and expense spreadsheets can be useful tools to help you see where your personal or business finances stand. These expenses are harder to account for in a budget as they dont always come with a set monthly fee. The Blueprint breaks down the steps to start tracking your expenses. If you own and rent a property held outside of a limited company you are taxed on all of your rental profit no matter how you distribute it. Creating a business expense spreadsheet is a good idea because without one it can have a serious impact and can endanger the success of your enterprise.

Affiliate relationships include but are not limited to Bluehost Amazon Associates and StudioPress. You can also use spreadsheet software. If your employees use computer screens as a big part of their job then they can claim eye tests as well as health checks as limited company expenses. Download free simple bookkeeping spreadsheet in Excel format here Buy unlocked bookkeeping spreadsheet file you will be able to amend all the cells in this file. Line 18a through Line 18c Tax-exempt Income and Nondeductible Expenses Enter on Schedule K 568 the amounts of tax-exempt interest income other tax-exempt income and nondeductible expenses from federal Schedule. The next step in setting up a budget is to list your monthly expenses. This confirms how much dividends you can pay. This calculator will deduct expenses pension contributions and salaries from your annual revenue to calculate corporation tax and to determine your net yearly and monthly profit. You can learn more about trading via a PSC from our comprehensive selection of limited company guides. Weve put together a simple spreadsheet to record all your income expenses and banking details.